Digital Process Transformation

Centralizing Business Processes for Enhanced Governance and Risk Mitigation at a Leading UAE Bank.

Read Case Study Start your Transformation

Centralizing Business Processes for Enhanced Governance and Risk Mitigation at a Leading UAE Bank.

Read Case Study Start your TransformationA leading bank in the UAE sought to improve its operational efficiency and enhance its governance and risk posture by centralizing its business processes and related documentation. The solution was implemented as a single, unified process repository.

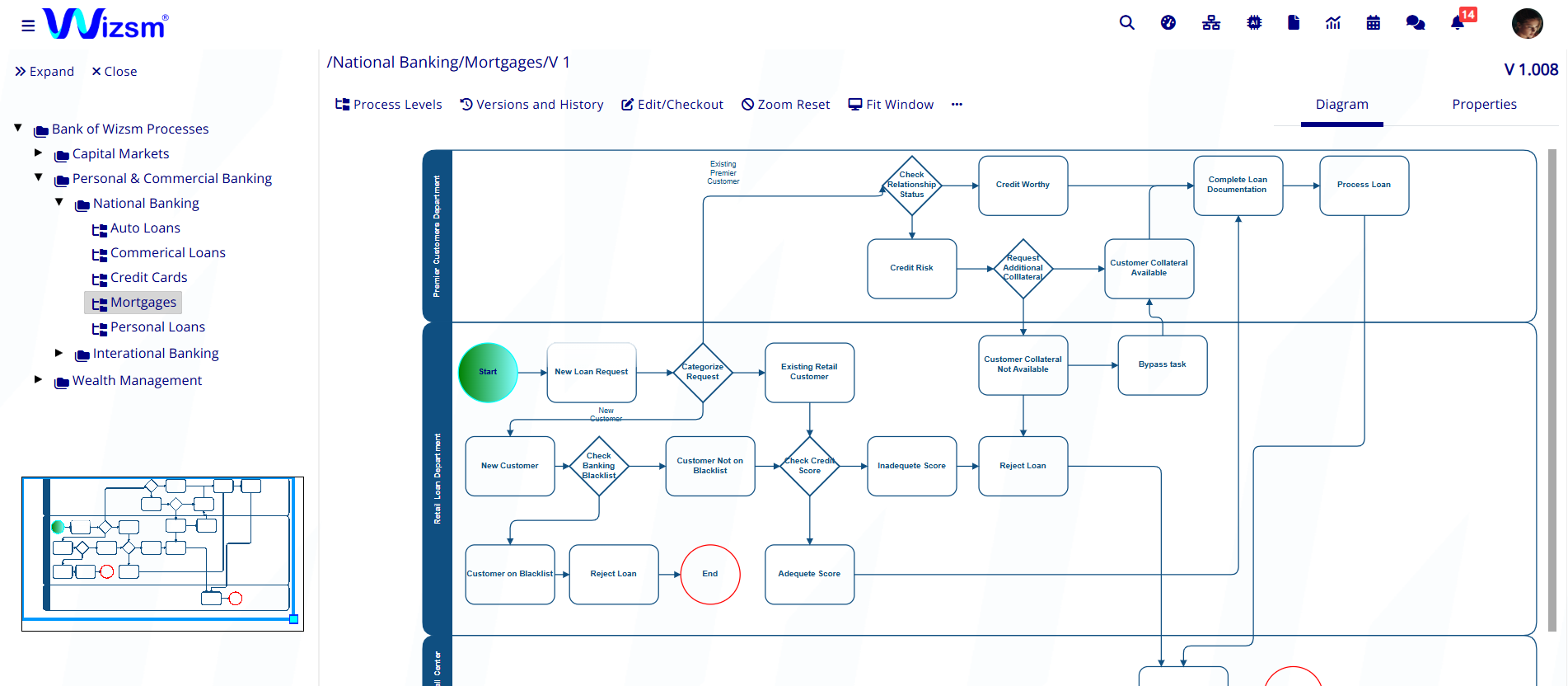

This solution streamlined the documentation of processes, improved staff understanding of procedures through graphical maps, and established a strong foundation for enhanced service quality and compliance, directly mitigating operational risks and strengthening the bank's operational controls.

The bank aimed to create a single point of reference for all business and support departments' processes to improve customer service and ensure better compliance with established policies and procedures. The existing approach lacked a centralized system, making it difficult for staff to easily access and understand various process maps, forms, manuals, and policies.

This lack of a single source of truth created a significant operational risk, as it was difficult to ensure all staff were adhering to the most current procedures and risk controls. There was a critical need for a structured solution that could consolidate all of this information into a single, accessible repository to both improve efficiency and mitigate risks.

Process maps, forms, and policies existed in departmental silos

Difficulty ensuring staff adherence to current risk controls

Inconsistent access to the most current procedures and documentation

The solution enabled the bank to create a centralized process repository, a one-stop-shop for all critical business documentation. The implementation focused on consolidating a wide range of documents from all business and support departments into the new repository.

The implementation focused on consolidating a wide range of documents from all business and support departments into the new centralized repository. This required close collaboration with the bank's Policies, Procedures & Processes Department (PPPD) to ensure all documentation was accurately mapped and uploaded.

The project's success hinged on the ability to migrate and organize the vast amount of information to be easily searchable and accessible for all users, thereby reducing the risk of outdated information being used. This effort was crucial for managing information risk and compliance.

Close partnership with the bank's process department for accurate mapping

Organizing and uploading vast amounts of information into the repository

Ensuring all documentation is easily searchable and accessible to all users

The implementation of the process repository has provided the bank with a clear path to achieving its stated goals. The solution has delivered the following key outcomes:

With direct access to accurate, up-to-date information, the bank's leadership is better equipped to make informed, strategic decisions, leading to enhanced compliance and service quality.

The project with the bank enables operational excellence and improves governance in the financial sector. By establishing a centralized process repository, the bank has built a strong foundation for continuous improvement, greater compliance, and superior customer service, positioning the bank for continued success and a more robust risk management posture.

The centralized process repository transformed our approach to risk management. Our staff now has a single, visual, and authoritative source of truth, which has been crucial in maintaining regulatory compliance and strengthening our governance structure.- Head of Policies, Procedures & Processes Department (PPPD), Leading UAE Bank

Join hundreds of organizations that have achieved breakthrough results with our strategic consulting expertise.

Start Your Transformation Explore Solutions